Tactical Investing: Merging Minds & Markets

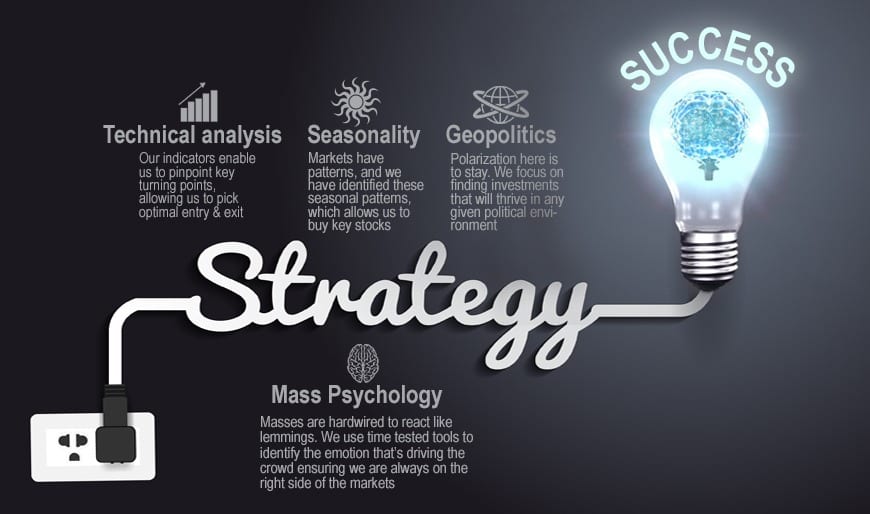

Tactical investing fuses mass psychology and technical analysis principles, enabling investors to make strategic decisions with a higher likelihood of success. This unique blend lies at the core of the Tactical investing approach, distinguishing it from other investment strategies.

Emotions quietly wield influence in the intricate dance of market trends and investment choices, like elusive puppeteers pulling unseen strings. Often overlooked, this emotional undercurrent is key in Mob Psychology, unravelling the market’s nuanced fabric. By deciphering these subtle emotional cues, we gain insights to anticipate trends and make astute investment decisions. It’s like deciphering the subtle cues from the market’s core. Infusing a bit of technical analysis refines our method, providing a gentle yet potent guide to venture into these investment paths at opportune times.

This approach has a solid track record, with most plays (around 81%) showing positive long-term trends.

The S&P 500 has slightly exceeded the 4800 mark. However, the onset of a significant correction could be delayed due to sentiment, which recently surged to 56 but then stabilized. If bullish sentiment doesn’t reach 60, sentiment will likely drop to the 40-45 range, followed by a market rally. Since bullish sentiment has traded below its historical average for almost 19 months, it would need to surge to extreme levels to signal that a strong correction is imminent. Market update Jan 19, 2024

On the other hand, the outlook is more favourable with the Russell 2000. Short-term traders might contemplate risking longs in the 1920 to 1935 range. However, it’s advisable to deploy funds in lots. For example, if this range is tested and you decide to go long on IWM or SAA, consider deploying one lot. If it dips lower, then the next lot, and so on. Market Update Jan 15, 2024

From a risk-to-reward perspective, the index offering the most promising ratio is the Russell 2000 (RUT). On a different note, certain technicians contend that the current rally might be a bear rally, despite its robust nature. We are not going to debate this issue until bullish sentiment reaches 55. For the argument to hold water, the respective index (NDX, SPX, etc) should not surge to new highs. (if they do, It will nullify their arguments ) Market update Dec 9, 2023

The overall outlook is unchanged, indicating that the SPX is still trending towards 4700. Market update Dec 9, 2023

Bonds are dangerously close to triggering a positive divergence signal, notably on the monthly charts. If this signal comes to fruition, brace yourself for a significant move akin to “bandits being chased by the hounds of hell.” The pattern has notably strengthened since the last update. Moreover, if this pattern unfolds, it will serve as a dangerously clear precursor to similar movements in markets like Palladium, Lithium, and others. Market Update November 12, 2023

Given that bullish sentiment still appears somewhat elevated, the potential for a selling climax looms larger. A selling climax involves swift and aggressive downward movements, typically occurring within a span of about five days. Such an event could push bearish sentiment readings beyond 51 while driving bullish readings below 21.00. Market update Oct 29, 2023

It (Rusell 2000) closed below 1830 on a weekly basis in the last week of September and traded as low as 1709, which technically fulfils the minimum downside targets. However, there is a reasonable possibility that it might experience another downward spike before reaching a bottom. The most apparent targets are within the range of 1620 to 1650. Market Update Oct 12, 2023

In September, it made more sense for risk-takers to take a short position. The current rally has an above-average likelihood of failing over the short term. Bearish sentiment has to spike, and markets usually bottom with a climatic sell-off. Hence, a test of the 4080 to 4140 range on the SPX is likely to coincide with a bottom, though don’t rule out the possibility of the SPX shooting down to the 4000 range. However, at this stage of the game, any spike down will be momentary.

Regarding the NDX, it briefly traded below 14550 but reversed course just as fast. A weekly close below that level would be needed to indicate a test of the 13500 to 13,700 range. If you are short, then use the downside targets of the SPX to close your short or, consequently, close them when the NDX trades below 13,950. Market Update October 12, 2023

If the Nasdaq closes at or below 14443 on a weekly basis, then the odds are quite high that it will test the 13950 to 14,050 range with an overshoot of 13,800. Again, if this happens, it’s a buying opportunity. Market Update Oct 5, 2023

From a purely technical standpoint, indices like the NDX and SPX could trend higher before pulling back. However, when we assess the risk-to-reward ratio, the risk doesn’t justify the potential reward.

If you believe you possess the agility, you might consider taking a long position with the hope that the NDX (Nasdaq 100) tests the 15,700 to 15,900 range. Once again, considering the risk-to-reward ratio, it’s wiser to capitalise on market rallies to expand your short position if you’re an aggressive trader.

Additionally, a breach below 14,550 would signal the potential for lower prices and a test of the 13,500 and 13,700 range. Market update Sept 7, 2023

We anticipate that between now and June, there is a good chance for the NDX to trade within the range of 13,650-13,900. Market update May 14, 2023

As a result, we anticipate the rally phase to continue for several weeks, extending into mid-April. However, most indices are expected to form lower highs, with the possibility of one index diverging. Given its current strength, the NDX is the leading contender for this divergence. It could potentially trade as high as 13,950 on the upper end, with a lower range of 12,900 to 13,200. Market Update March 21, 2023

TLT traded as low as 98.88, achieving the stated objective. It will likely rally to the 104.50 to 105.30 ranges (former support turned to resistance) before trending lower. A test of 93 is still a possibility. Market Update March 7, 2023

As of now, the Dow is consolidating and trying to gain momentum to test the 34K plus range. Among the indices, the NDX and the Nasdaq are exhibiting the most strength and deserve close scrutiny. However, it is important to note that the NDX should not close below 11,960 on a daily basis. For those who are willing to take on higher risk, using instruments such as UDOW, TQQQ, TNA, URTY, etc., may provide opportunities to benefit from this potential trade. Market Update, March 7, 2023

As long as it doesn’t fall below 18,000 on a monthly basis, the outlook for BTC remains positive. It has now established a trajectory that could lead to a test of the range between 25,500 to 29,009. Market UpdateFeb 9, 2023

It rallied as projected, and it traded within the suggested targets. Currently, the Dow is trading in the insanely overbought ranges on the daily charts, so the odds favour a sharp pullback. A test of 32,500 to 32,700 is likely, with a possible overshoot to 32,100. Market Update January 30, 2023

This came to pass, and after pulling back for several days, the Dow is getting ready to put in another intermediate bottom. A test of the 34,000 to 34,500 range is likely, with a possible overshoot to 34,900 before the next downward leg. Market Update January 7, 2023

TLT pulled back as projected, but it ended the week below 101. It is likely to rally to the 108 to 109 ranges and then pull back (as low as 96) before putting in a more solid albeit intermediate bottom. However, a weekly close at or above 108 will indicate that a multi-week base is in place. Market Update January 7, 2023

The daily charts are close to trading in the extremely oversold ranges. Hence an interim bottom is likely. The ideal scenario calls for them to rally to the 29 to 30 of this month and then drop lower into January 2023. Market Update Forum Dec 20, 2022

The easy trade is over; yesterday’s action partially confirms it. This does not mean that markets can’t run higher; it simply implies that you will need to work harder for your coin from here onwards. In other words, volatility levels will surge. Dec 4th update, 2022

The Dow managed to end the week above a key short-term zone of resistance (32,250); by closing above this level on a weekly basis, it has set the path for a test of the 34,300 to 34,650 range. Market update October 31, 2022

If the markets follow the projected path from October, a test of the 9,900 to 10,500 range will probably mark a bottom. In other words, if they follow the 1973-74 pattern, a test of the above ranges will make for an enormous opportunity. Will the Nasdaq follow this path; nothing is written in stone. However, if it were to happen, it would provide a mouth-watering opportunity for Tactical Investors. Market Update, Sept 11, 2022

Risk takers should continue holding until the Dow tests the 33,600 to 34K ranges and the Nasdaq trades to 13,500. At that point, all the higher-risk positions opened should be closed. You can also modify this trade in line with your trading style. Market Update September 11, 2022

Short term, the markets are entering a corrective phase; the SPX has hit short-term targets. Former support points turned into resistance which should turn into zones of support again, albeit on a short-term basis. The likely pullback targets fall in the 3960 to 4020 with a decent chance of overshooting as low as 3870. Market Update August 2, 2022

It appears likely that the market will experience two corrections this year. The first one, which could already be underway, is expected to occur in the 1st quarter. The 2nd one is more likely to occur towards the end of the 3rd quarter to the 4th quarter.

This year, two corrections and lots of volatility would be the best way to destroy the vast majority of investors and rob them of all their hard-earned gains. Market update Jan 11, 2022

A period of unusually explosive and irrational price movement is almost always followed by a brutal bloodletting period. Does this mean everyone will lose? Note all astute investors will have the chance to get into many quality companies that will sometimes take on gains in the 360 to 560 per cent ranges. Market Update Dec 27, 2021

Hence the argument that the markets will likely experience a more substantial correction in 2022 continues to gain traction. The markets have not experienced a robust discipline for a while. They could shed 18% on the low end and 24 to 27 per cent on the high end. The odds are that the trend will remain intact, and this strong correction will lead to the birth of an even spunkier bull.Market update Nov 2021

Not one investor in the world can prove that giving into panic paid off over the long run. If they dare attempt to take this challenge, this graph will end any rubbish argument they come out with. The recovery rate from crash to boom will accelerate as the money supply rises. Look at how fast the markets recouped from the COVID crash. Market Update August 29, 2021

Everybody panics when the word correction or crash comes to mind, but what 99% forget is that those that buy during this phase bank massive profits. The only intelligent game plan is to look at the masses and take the opposite stance. Jump in when they panic and vice versa. This is the game plan the top players have relied on since the inception of the stock market. Market Update Aug 21. 2021

Looking at the two indicators posted below, one can see that the market is still experiencing a silent correction. The market of disorder could (“could” being the operative word) be pulling the wool over all the expert’s eyes. Everyone keeps stating that the market needs to let out steam, and maybe the opposite might come to pass. We know that market tops occur when the masses are euphoric. Sentiment analysis reveals that the herd is far from ecstatic. Additionally, the number of experts calling for a pullback continues to increase. Market Update August 4, 2021

Not one stock market guru or expert can pull up a long-term chart and prove that being a bear or sitting on the sidelines paid off. Every crash led to the birth of a new bull market. Market Update June 18, 2021

What about the “it’s different” this time argument? Rubbish!! that is all we have to say to anyone coming up with that line. Look at the above chart. Can you even pinpoint the great depression or the so-called deadly crash of 1987? Every crash gave birth to a new baby bull. The key to banking vast sums of money is always to have some cash at hand and, most importantly, never over-commit funds to a single position. As long as the trend is on our side, we have to view every pullback through a bullish lens. Market Update May 12, 2021

If the MACDs complete the bullish crossover at this level, it will create a pattern that usually results in a fast upward move. The Nasdaq could then very easily trade to the 14,500 range with a possible overshoot to 15,000. After that, it could shed up to 2000 points before building up energy to challenge 18,000 ranges. Market Update April 30th, 2021

If the trend is up, no matter how sharply the markets pull back, do not panic, even if every expert and his grandma are telling you it’s time to flee for the hills. Market Update March 11, 2021

It is relatively easy to make money in the markets once you have mastered the art of patience and discipline. Failure to master these two skills will virtually guarantee a negative outcome. The reason most investors lose money is that they have no plan. When things look good, they jump in and vice versa. Now ask them what makes an investment look sound or great, and they will reward you with the proverbial idiotic answer “because the experts” said so. The simple, time-tested methodology that has never failed over the generations is that one should never buy when the masses are euphoric and vice versa. Market Update, Feb 14, 2021

It is quite likely now that the Nasdaq, which is leading the way up, will test the 14K plus ranges. The Nasdaq could end the week above 13390, and if it does, it is likely to trade to the above targets. We will issue some new plays today, but we are only going to get into extremely oversold stock, and we will only deploy 1/3rd of our funds at this stage. Market Update Jan 25, 2021

Many investors are stating they are itchy to jump into the markets; isn’t this bloody amazing? When the markets were crashing last year, and we were telling everyone to buy, they wanted to do the opposite. Now we are stating that it’s time to hold the gunpowder dry, and they want to move in the opposite direction again—a classic replay of the secret desire to lose syndrome in action. Misery loves company, and stupidity simply demands it. The average mindset is wired to lose, so when you feel sure about something, check ten times before you get into it. Certainty about the markets is probably the best signal that you will get hammered. Market Update Jan 11, 2021

Most investors react to disasters by panicking and throwing the baby out with the bathwater; in recent times, they have thrown the babysitter and the entire family out too. Disaster is the code word for opportunity, especially when it comes to the financial markets. Lastly, remember how far the Dow has rallied off its low in March; the naysayers only focus on the pullbacks but not on the big upward moves the market experienced before the pullback, for if they did, it would shatter their already pathetic record. Market Update Nov 13, 2020

Neutral readings have more or less remained constant since the markets bottomed. What is worse than fear? Uncertainty. At least when you are fearful, you have something to focus on. When you are uncertain, you are like a Yo-Yo swinging from one side of the fence to the other. The longer the crowd remains sceptical, the higher this market will run. If we had to make what is sometimes referred to as an educated guess, it is all but certain that the Nasdaq will trade to and past 15K. Market Update Sept 30, 2020

The Dow has shed more than 1500 points from high to low. When a market sheds weight for three-plus days in a row without any real trigger, the next step is for the market to attempt to put in a bottom. Market Update Sept 9, 2020

As the Dow is all but guaranteed to take out 30K, traders willing to take on some risk could deploy extra funds in portions into DIA 300 calls (as high as 340 would be fine) whenever the Dow pulls back strongly. Every other index is now playing catch up to the Nasdaq; in a way, it’s sort of like the dogs of the dow theory, which inadvertently states that every dog will have its day in the sun. Another reason that the Dow is lagging and the Nasdaq is soaring is because the dumb money, which is the vast majority of players, is still sitting on the sidelines. Market Update Aug 11, 2020

Don’t fall for the sky is falling hype, for we have a Fed that is hell-bent on destroying anyone that dares to challenge them. You are going to see some big names get destroyed before this bull is over as these big names, in their infinite wisdom, will decide to take on the Fed, and as expected, the result is that they will end up dead, as in dead broke. Market Update July 12, 2020

There has never been a period where bearish sentiment has remained negative for weeks on end while the markets continue to soar without letting out any steam. This insane intervention by the Fed also informs us that this bull will indeed soar to unimaginable heights. It could very well end up becoming the modern version of Tulip Mania. Market update May 31st, 2020

It appears that markets are experiencing the “backbreaking correction” one, which every bull market experiences at least once and is often mistaken for the end of the bull. While it feels like the end of the world, such corrections always end with a massive reversal. Given the current overreaction to the coronavirus, there is now a 70% probability that when the Dow bottoms and reverses course, it could tack on 2200 to 3600 points within ten days. Interim Update March 9th, 2020

A sharp pullback is still an outcome we view through a very bullish lens. The ideal setup calls for the Dow to trade in the 28,800 to 29,000 range, with a possible overshoot to 29,300. After that, a nice sharp pullback would set the bedrock for a surge to and possibly well past 30k. Market Update Dec 29, 2019

Tactical Investor Site Disclaimer

The Tactical Investor does not give individualised market advice. We publish information regarding companies we believe our readers may be interested in, and our reports reflect our sincere opinions. However, they are not intended as personalised recommendations to buy, hold, or sell securities. Investments in the securities markets, especially options, are speculative and involve substantial risk. Only you can determine what level of risk is appropriate for you. Continue to read the disclaimer in full.

Contact Us

Refund Policies

Site Map

Precious metals dealer

Tactical Investing blends Crowd Behavior analysis with technical analysis, foreseeing market trends and pinpointing crucial turning points.