Challenges in Technical Analysis of The Financial Markets

Updated March 24, 2024

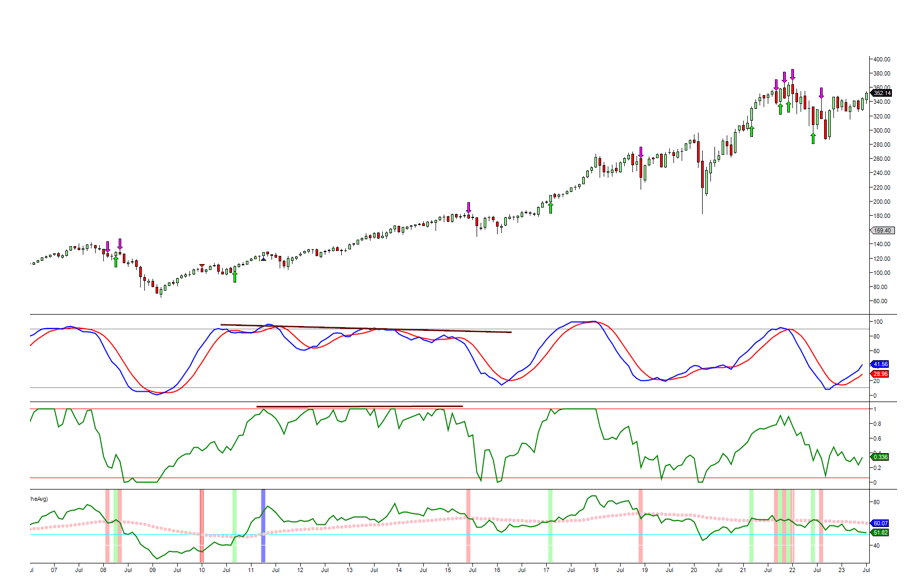

Technical analysis (TA) and mass psychology (MP) are key forces shaping financial markets. From late 2009 to mid-2015, the Dow’s monthly chart via DIA showed a strong uptrend, yet TA alone might have signalled caution and missed out on substantial gains. As John Bogle noted, “The two greatest enemies of the equity fund investor are expenses and emotions.” MP helps explain market moves that TA misses.

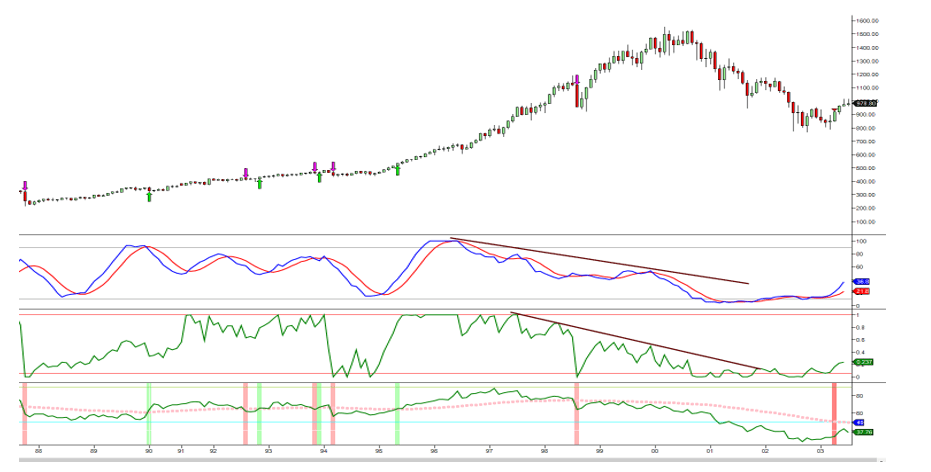

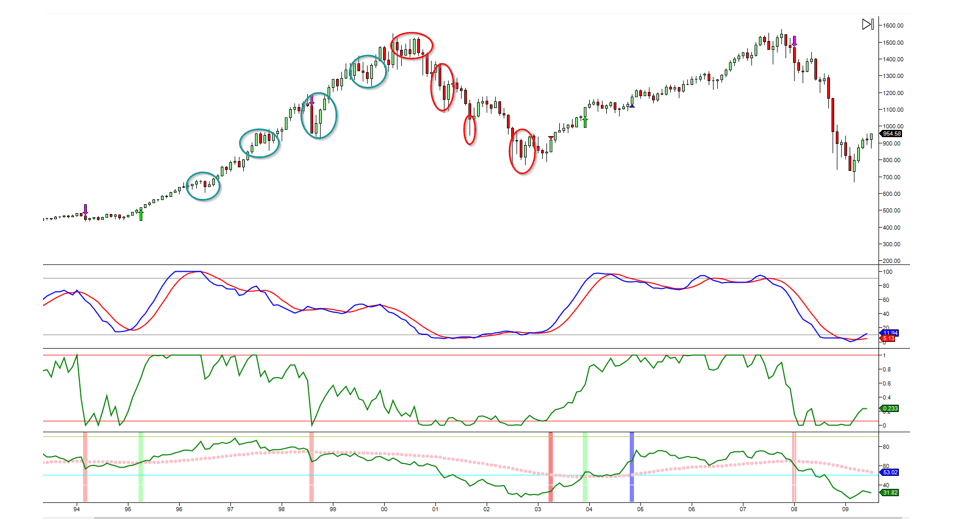

Relying solely on TA can be risky, as the 1996-2001 period shows. Livermore warned, “At long as a stock is acting right, and the market is right, do not be in a hurry to take profits.” Negative divergences advocating short positions would have led to significant losses, and the deceptive 2001 buy signal added to the pain. TA only regained reliability in March 2003.

MP provides crucial context. As Charlie Munger teaches, “The best way to learn how hard investing can be is to do it for yourself.” Human emotions, biases, and beliefs drive markets in ways TA cannot always predict. While manipulators may sway short-term trends, the market reverts to the mean.

Combining TA and MP yields a more balanced approach. TA illuminates trends, but MP is the north star. Studying both, as top investors like Buffett and Munger do, is vital. As Livermore said, “There is nothing new on Wall Street” – timeless lessons from years ago still apply.

Navigating financial markets requires uniting technical analysis and mass psychology. Over-reliance on either is dangerous. They offer a comprehensive lens to interpret market movements and inform resilient investing strategies. The wisdom of Bogle, Livermore, and Munger reinforces the importance of this multifaceted approach.

Embracing Pullbacks and the Supremacy of Mass Psychology

Even in 2015, many TA experts hesitated to enter as the pullback was minor. Jesse Livermore noted, “There is only one side to the stock market, not the bull or bear sides, but the right side.” We embraced every withdrawal, including the COVID crash, because mass psychology (MP), sentiment readings, and trend indicators supported this stance.

Recent sentiment patterns have been abnormal, prompting caution. John Bogle warned, “The two greatest enemies of the equity fund investor are expenses and emotions.” While TA can sometimes work well, **we will never rely on it alone.** Even with short-term challenges, we believe MP reigns supreme long-term.

As mentioned, big players can manipulate short-term trends but not long-term ones. Markets always revert to the mean eventually. Charlie Munger’s wisdom applies: “The big money is not in the buying and selling but in the waiting.”

The 1970s, 1980s, 1990s and other periods show the risks of relying solely on TA or fundamentals. The yearly S&P 500 chart illustrates this unpredictable behaviour:

Livermore’s insight is timeless: “There is nothing new on Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.”

Technical Analysis Trials: The Perils of Misleading Signals

From June 1996 to nearly the end of 2001, technical analysis (TA) specialists might have strongly considered shorting the markets due to indicators displaying multiple negative divergence signals. However, they would have lost a significant fortune if they pursued this path. From a TA perspective, the chart below seems to almost implore one to take a short position. Indeed, adhering to that line of thought would have resulted in a highly unfavourable outcome.

Then, in late 2001, a glimmer of hope appeared, only to be swiftly snuffed out: The Market presented a deceptive buy signal. Despite hitting lows in September 2001, the SPX plummeted an additional 20% before finally reaching its bottom. Imagine spending five years figuring out the trend, only to get a false buy signal and endure another 20% loss. Many investors today would find it challenging to muster the confidence to reinvest after such a setback.

Let’s zoom out and examine the bigger picture. Technical analysis (TA) didn’t start working well again until March 2003. So, ask yourself this question: Would you have the courage to jump back into the Market after enduring losses for close to seven years?

Moreover, even when TA started to work again, it began giving false sell signals as the SP500 traded in the exceptionally overbought range from 2004 to 2008, issuing numerous misleading sell signals.

In contrast, Mass Psychology (MP) would have prevented this dangerous dance of death, which is precisely why we have unwavering confidence in it.

Exercising Caution: The Confluence of Factors Impacting Market Prudence

“The following contents have been excerpted from the July 23, 2023 market update.”

– Bullish sentiment is almost at 55.

A concerning trend persists as 34 world economies exhibit inverted yield curves, signalling underlying issues. This, coupled with the reflection in the Baltic Dry Index, suggests that all is not well. In the short term, this situation implies increased volatility and the potential for chaos. However, in the long term, it puts pressure on the Federal Reserve to adopt the “Print baby Print” approach or face dire consequences.

– The hype around LLM models is dying as they are not as infallible as previously portrayed.

– Michigan consumer sentiment reading for July is 72.6, the highest since Sept 2021.

– The CNN Fear Greed index is in the extreme greed section.

– The Anxiety gauge is in the middle of the “moderate zone” and may move to the mild zone.

– The McClellan Summation index reading is close to 2000, indicating extreme greed.

– Market Momentum for Nasdaq and SP500 indicates extreme greed.

– Smart money is moving from Tech to Industrials, commodities, and healthcare.

The put-call ratio is meagre.

While these factors may not appear significant individually, it is crucial to exercise caution when considering their combined impact alongside Mass Psychology. If you are heavily invested in the few stocks that powered the AI mania, it would be prudent to consider scaling back on many of these plays.

Concluding: The Synergy of Technical Analysis and Mass Psychology

Combining technical analysis (TA) and mass psychology (MP) has proven to be a powerful strategy for navigating financial markets. As Peter Lynch noted, “In the stock market, the most important organ is the stomach. It’s not the brain.” Relying solely on TA can lead to significant losses, as seen from 1996 to 2001 when negative divergences and false buy signals misled investors.

Machiavelli’s wisdom applies: “There is nothing more difficult to take in hand, more perilous to conduct, or more uncertain in its success than to take the lead in introducing a new order of things.” After nearly seven years of losses, TA only became more reliable in March 2003. From 2004 to 2008, TA continued to generate false signals in an overbought market.

MP recognizes the role of emotions and biases in driving market sentiment. As Mencken observed, “The men the American people admire most extravagantly are the most daring liars; the men they detest most violently are those who try to tell them the truth.” Big players can manipulate short-term trends but not long-term ones.

**TA helps identify trends, but MP is the long-term driver.** Lynch’s insight applies: “The key to making money in stocks is not to get scared out of them.” Factors like inverted yield curves, the Baltic Dry Index, and volatile sentiment are best addressed through this combination.

While TA is crucial for understanding market patterns, MP is the ultimate guide. As Mencken quipped, “For every complex problem, there is a simple, neat, and wrong solution.” Navigating financial markets requires a multifaceted approach grounded in both TA and MP. This synergy, supported by the wisdom of Lynch, Machiavelli, and Mencken, offers a resilient path through the labyrinth of investing.

Horizons of Knowledge: Exceptional Perspectives

Investor Sentiment Index Data: Your Path to Market Success

Unraveling Market Psychology: Impact on Trading Decisions

Is Value Investing Dead? Shifting Perspectives for Profit

Dogs of the Dow 2024: Barking or Ready to Bite?

What happens when the stock market crashes? Opportunity!

The Trap: Why Is Investing in Single Stocks a Bad Idea?

How Can Stress Kill You? Unraveling the Fatal Impact

Clash of Titans: Unleashing Inductive vs Deductive Reasoning

Financial Mastery: Time in the Market Trumps Timing

Investment Pyramid: A Paradigm of Value or Risky Hail Mary?

Contrarian Investing: The Art of Defying the Masses

Quantitative Easing: Igniting the Corruption of Corporate America

Uranium Market Outlook: Prospects for a Luminous Growth Trajectory

Stock Investing for Kids: Surefire Path to Success!

An Individual Who Removes the Risk of Losing Money in the Stock Market: A Strategic Approach

Mind Control Techniques: Mastering Market Dynamics for Success